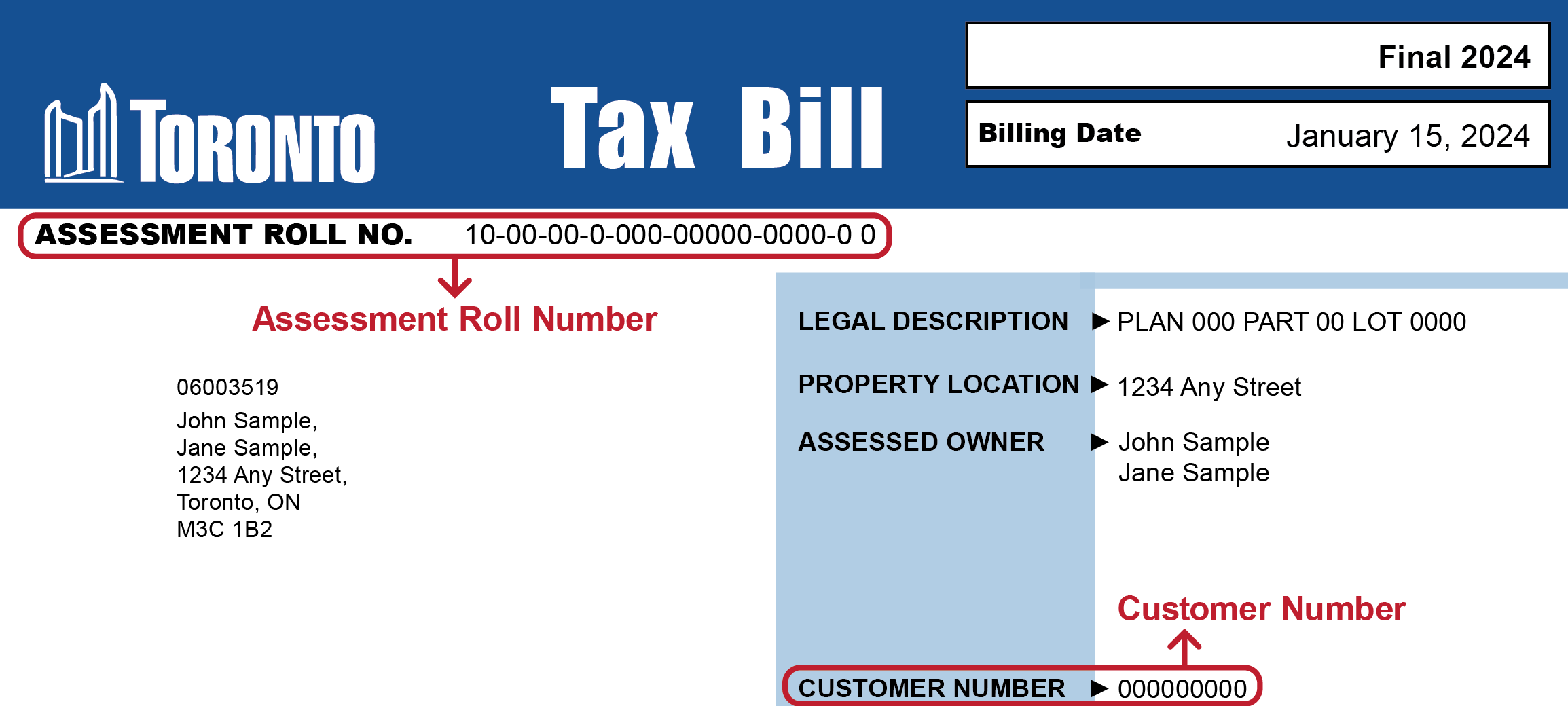

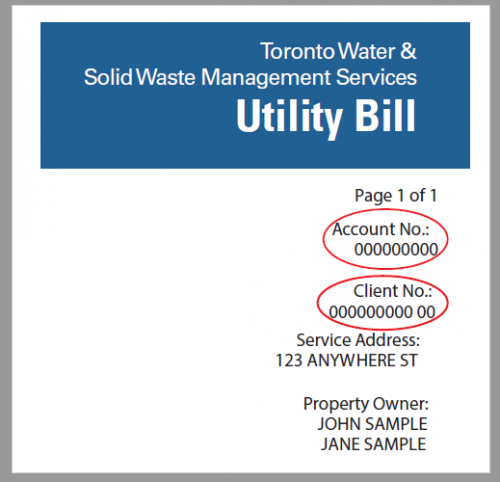

For property tax payments you will need your property tax roll number and for utility bill payments you will need your account number and client number.

To make a payment to your tax or utility account through online banking you must set up the City of Toronto as a payee. If you need assistance contact your bank or financial institution directly. For your convenience, the following banking websites and payee listing are provided below:

| Financial Institution | Property Tax | Utility Bill |

| BMO (Bank of Montreal) | Toronto, City of, Property Taxes | Toronto, City of, Utility |

| CIBC (Canadian Imperial Bank of Commerce) | Toronto (City of) Property Tax | Toronto (City of ) Utility Bill |

| National Bank | City of Toronto Tax | City of Toronto - Utility |

| RBC (Royal Bank of Canada) | City of Toronto Property Taxes | City of Toronto Utility Bill |

| Scotiabank | Toronto (City) Property Taxes | Toronto (City) Utility Bill |

| TD Canada Trust | Toronto (City of) Property Taxes | Toronto (City of) Utility Bill |

Subject to change without notice.

You can pay the Vacant Home Tax at banks or financial institutions through online banking, telephone banking, at an automated teller machine (ATM) or in-person.

To register and pay through online banking:

Please make payment a few days in advance of the due date to ensure payment reaches the City prior to or on the due date.