The City provides annual operating funding to child care centre operators in two ways:

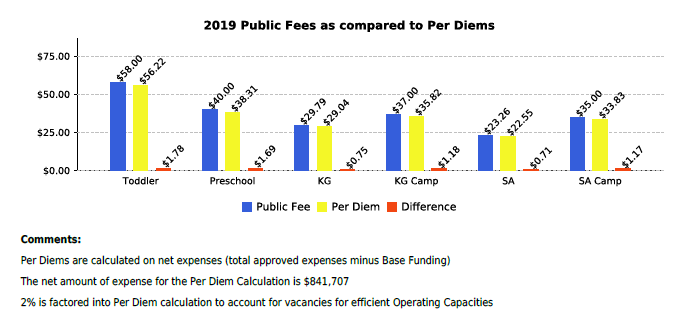

Per diems are calculated based on the ‘net approved expenses’ to prevent double funding. The ‘net approved expenses’ are the total approved expenses in the budget minus any base funding sources such as General Operating Funding or United Way Funding. The City determines per diem rate increases for service providers annually, based on the total costs approved for all contracted service providers and Council approved funding levels. City Council approval is required in order to increase the per diem rates/funding paid to a service provider.

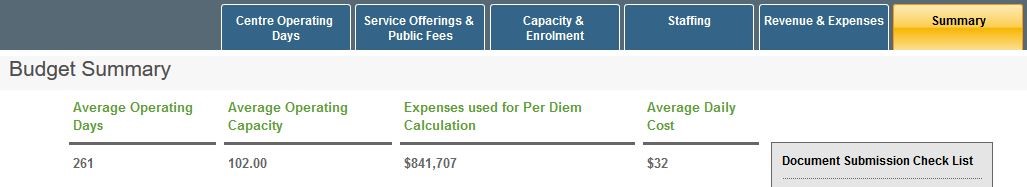

The ‘net approved expenses’ are shown in the summary tab of the Budget submission as ‘Expenses used for Per Diem Calculation’ (Figure 1) and in the Feedback Report (Figure 2).

The factors for calculating a per diem include:

The per diem is calculated for each service offering by spreading the net approved expenses over the number of children and number of days of service. The costs are weighted to each service according to the amount (percentage) of revenue generated by the public fee for each service. The per diem will not pay a higher amount than the Public Fee Revenue will generate.

The City recognizes that there are days where some services do not generate revenue because there are no children filling the space. This happens naturally as a result of children aging into a new age group, or new children starting in the program gradually. To provide some financial support for this lost revenue, an ‘optimal enrolment’ rule is applied to the per diem calculation.

The ‘optimal enrolment’ rule is a factor applied to each service where the program is operating with efficient group sizes (see Budget Guidelines for Child Care for efficient group sizes). For each service offered in a room that is operating efficiently, the net approved expenses are spread over 98% of the planned enrolment. By spreading these net approved expenses over fewer children, the per-unit cost is now higher, resulting in the per diem being 2% higher.

| Optimal Enrolment Rule | Age Group Preschool | Operating Days | Calculated Days | Net Approved Expenses for this age group | Divided by Calculated Days | Per Diem |

|---|---|---|---|---|---|---|

| @ 100% | 24 | x 261 | = 6 624 | $350 000 | / 6 624 | = $55.87 |

| @ 98% | 23.52 | x 261 | = 6 139 | $350 000 | / 6 139 | = $57.01 |

Per diems are calculated each year, based on the net approved expenses. These expenses are spread in an equal percentage over the number of days of service, the number of children served, based on how much revenue the public fee generates.

If there are changes to the public fees, the days of service, the number of children served, or the net approved expenses the resulting per diems will change as well.

Changes to any of these items will result in a different per diem compared to the prior year, and when the net approved expenses greater than the prior year, the per diem will be paying more revenue than the prior year.

If all of the submitted costs in the budget are approved, the per diem is paying what it costs to provide the service, regardless of whether each per diem is less or more than the prior year, or less than the public fee for that service.

It is important to note that the per diem will never be higher than the public fee for the service.

For example, if the public fee is set for $30 to provide service to 100 children for 100 days and the net approved expenses for all 100 children is $310,000 (310,000/10/100 = $31) the per diem will be set at $30. This means that the public fee was not set to cover all costs.

More General Operating Funding reduces the net approved expenses, which can result in lower per diems depending on changes to the other factors, and should also result in lower public fees. The reduced net approved expenses mean that more of the required revenue will be paid in the form of base funding, and less will be needed from public fee/per diem revenue.

For example, if the per diem was $30.61 to provide service to 100 children for 100 days with net approved expenses of $300,000, and the centre now receives $30,000 in General Operating Funding this will reduce the net approved expenses ($300,000 – $30,000 = $270,000) and the new per diem will be $27.55 ($270,000/100 days/98 children [assumes centre is efficient and optimal enrolment of 98% is part of the calculation]).

Programs that are not operating with efficient staff to child ratios do not benefit from the 98% optimal enrolment factor and the per diem is spread over 100% of the children, resulting in less revenue in per diem.

For example, if the net approved expenses are $300,000 for 100 children for 100 days and the centre is not operating with efficient staff to child ratios, the per diem will be: $300,000/100 days/100 children = $30.00

The calculation for efficient ratios would be at 98% optimal enrolment: $300,000/100 days/98 children = $30.61

Increases to the number of children or number of days of service usually results in a lower per diem because the costs are spread over more children and/or more days.

For example, if the per diem was $30.61 to provide service to 100 children for 100 days with net approved expenses of $300,000, and the centre adds another 10 children for 100 days with net approved expenses increase of $20,000, the per diem would be $29.67 ($320,000/100 days/107.8 children [assumes centre is efficient and optimal enrolment of 98% is part of the calculation]).

Significant decreases to the number of children and or number of days of service usually results in a higher per diem because the fixed costs are spread over fewer children and/or days.

For example, if the per diem was $30.61 to provide service to 100 children for 100 days with net approved expenses of $300,000, and the centre decreases their capacity to 50 children for 100 days with net approved expenses now $160,000, the per diem would be $32.65 ($160,000/100 days/49 children [assumes centre is efficient and optimal enrolment of 98% is part of the calculation]).

Budgets should be based on achievable service levels. If the service level is not achievable, unrealized revenue can create financial pressures. In addition to the unrealized revenue, budgets that are based on higher service levels than it is possible to achieve will have the net approved expenses spread over more children resulting in a lower per diem per child.

In some instances the City will limit the amount of per diem rate based on what is considered a reasonable range of expense for a particular service. For example, escorted kindergarten service offerings 2340, 2341 and 2342 are capped at a percentage of the per diem for the preschool 1330 service offering.

Raising public fees may not necessarily result in higher per diems. Per diems are calculated based on the cost to operate.

For example, if the net approved expenses are $300,000 for 100 children for 100 days, the per diem will be calculated as $300,000/100 days/98 children = $30.61, no matter how high the public fee revenue is set.

Changes to how fees are set – varying percentages of change to a fee structure will result in changes to how the per diems are calculated. This change to services may result in a change in distribution of approved costs, but it does not mean less revenue.

For example, if a centre raises fees by different percentages for different services, the net approved expenses will be allocated based on how much revenue the public fee generates adjusting to the new fee strategy the centre has planned. This example only illustrates the public fee change, it does not show operating capacities or number of days.

2018 Net Approved Expenses: $985,678

| Age Group | Public Fee | Per Diem |

|---|---|---|

| Infant | $90 | $88.91 |

| Toddler | $70 | $69.15 |

| Preschool | $55 | $54.33 |

2019 Net Approved Expenses: $1,014,454

| Age Group | Public Fee | Public Fee Increase | Per Diem | Difference in Per Diem |

|---|---|---|---|---|

| Infant | $90.90 | 1% | $88.84 | .08% decrease |

| Toddler | $71.40 | 2% | $69.78 | .91% increase |

| Preschool | $58 | 5.45% | $56.68 | 4.33% increase |