Short-term rental operators are people renting their homes or rooms on a short-term basis, for a period of less than 28 consecutive days.

Short-term rental operators must register with the City in order to operate in Toronto. Learn about the rules below and register online.

Operators must renew short-term rental registration every year. Learn about the requirements below and renew online.

Operators must collect and remit a six per cent (6%) tax. Effective June 1, 2025 to July 31, 2026, operators must collect and remit an 8.5% tax. File a tax report for each reporting period.

In 2023, the City evaluated the implementation of the short-term rental bylaw to examine its progress and identify areas for improvement. In 2024, City Council adopted updates to the bylaw, which will come into effect in three phases on June 30, 2024, September 30, 2024 and January 1, 2025.

A short-term rental is all or part of a dwelling unit rented out for less than 28 consecutive days in exchange for payment. This includes bed and breakfasts (B&Bs) but excludes hotels, motels, other accommodations where there is no payment and a dwelling unit normally used as a student residence that is owned or operated by a publicly funded or not-for-profit educational institution.

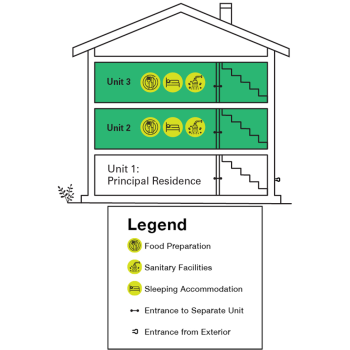

A dwelling unit is a separate or self-contained living accommodation for a person or persons living together as a single housekeeping unit in which both food preparation and sanitary facilities are provided for the exclusive use of the occupants of the unit. This includes secondary suites, laneway suites, garden suites, or similar accommodation.

You can short-term rent in any housing type, for example house, apartment or condominium, as long as it is your principal residence.

The image in this section shows a triplex with the principal residence on the first floor (unit 1) and two self-contained units on the second and third floors (unit 2 and 3). Each unit has a separate entrance and includes a food preparation area, sanitary facility and sleeping accommodation.

To short-term rent, you must be:

Homeowners

Tenants

Multiple individuals living in the same home

Registration and payment for your short-term rental need to be completed online.

During the registration you will need to certify the information provided, declare that your residence meets the Ontario Fire Code and the Ontario Building Code, and authorize the collection of information.

Register Your Short-Term Rental

If you have any questions, please contact the Short-Term Rentals team at ShortTermRentals@toronto.ca or 416-395-6600, Monday to Friday. 8:30 a.m. to 4:30 p.m.

When registering online, you need to provide the City with information, including

As of September 30, 2024, you will need to provide at least two pieces of documentation in addition to your government-issued identification to provide additional evidence of principal residence. Examples include but are not limited to utility bills (i.e. internet, phone, hydro), purchasing and rental agreements, vehicle insurance and/or registration, notice of assessments and related employment and/or financial statements.

Note: Before submitting information to the City, you must obtain consent from your contact(s) using the Consent for Alternate (Emergency) Contact Persons form. It is your responsibility to ensure that your alternate (emergency) contact has consented before you submit their contact information. Please keep a record of this consent.

You need a government-issued identification (ID) to demonstrate that you are over the age of 18 and to show evidence of your principal residence. Only the following IDs, which include your address, are accepted:

The name(s) used in your registration application must match your ID.

Your government issued ID (Ontario Driver’s License or Ontario Photo Card) must be valid and in good standing.

If you do not have the required government-issued ID, you need to obtain it before registration. This may involve updating a home address on a current licence, converting an out-of-province driver’s licence to Ontario, or applying for an Ontario Photo Card. Note that it may take four – six weeks to receive your Ontario Photo Card.

You are required to pay a registration fee of $55.35 in 2024. The registration fee is subject to an annual increase.

Starting January 1, 2025, the registration fee will increase to $375.00.

This is a non-refundable registration fee regardless of if the application is approved, denied or refused. If approved, your permit is valid for one year from the time your registration was approved. Should your application be approved, your registration will be valid for one year from the date the registration was approved. Fees can be paid using only a valid credit card. Debit cards, Visa Debit or Visa gift cards are not accepted by the online registration system.

Please note that you are not eligible to register your short-term rental if your registration was denied, revoked or refused in the last 12 months. For example, if your application for a short-term rental registration was finally denied, revoked or refused on January 5, 2024, you will need to wait a year, and the earliest you can apply again would be on January 6, 2025.

After you provide your information and make payment, the City will validate the information and review your application.

As of September 30, 2024, you may be required to attend an in-person interview with City staff at a designated location and provide any information or documents related to your registration or application as requested.

If your application is approved, a registration number will be generated and emailed to you, along with a Good Operator Guide. The guide was last updated in June 2024.

The City aims to process your application as soon as possible, however the City experiences a higher than normal volume of applications at times. While some applications are processed and approved automatically, others may require additional review and/or an inspection of the property prior to approval, which may lead to delays in processing your application. Depending on the volume of applications, processing time may exceed 90 days following submission of applications.

Please remember that you can short-term rent your home in Toronto, only if you are a registered operator. The valid City-issued registration number must be included in all your advertised listings.

As of September 30, 2024, your principal residence may be inspected by City staff on an annual basis or as part of an investigation; you will be required to attend these inspections. Another individual or a representative from an organization cannot attend inspections on your behalf.

The City can deny your registration application based on the eligibility criteria, and will inform you of its intention to deny the registration. You will then have an opportunity to provide evidence and information to explain why your registration should not be denied.

Please note that you are not eligible to register your short-term rental if your registration was denied, revoked or refused in the last 12 months. For example, if your application for a short-term rental registration was finally denied, revoked or refused on January 5, 2024, you will need to wait a year, and the earliest you can apply again would be on January 6, 2025.

Once you have registered as a short-term rental operator, you must:

Download the frequently asked questions on advertising and listing short-term rentals online.

Upon receiving your City-issued short-term rental registration number, you must post this number on all your advertising and listings. Any invoice, contract, receipt, or similar document related to your short-term rental must include your short-term rental registration number.

When advertising or listing your short-term rental, ensure that the information in your listing is an exact match with the information on your short-term rental registration with the City. Examples of incorrect listing information that does not match registration data may include operators using nick names instead of their full name as listed on government-issued identification, using incorrect postal codes, adding in building names rather than street addresses, not including unit numbers, or placing unit numbers in the wrong field etc.

If the information on your listing does not match the registration information, or if your listing has missing or inaccurate information, then this could lead to the short-term rental company removing your listing and/or cancelling your reservations. To avoid this, check that your:

As part of ongoing compliance audits, the City uses data discovery techniques to validate short-term rental activity in Toronto. The City also works closely with short-term companies to identify and remove listings that do not have a valid registration number; has missing, inaccurate or incomplete information; or are not in compliance with the bylaw.

If your short-term rental listing has been delisted, please contact str-compliance@toronto.ca and include the following information in your email:

Once the issue of missing, inaccurate or incomplete listing information has been addressed, operators need to submit a screenshot of their updated listing so that the City can verify and approve. Operators can then proceed with relisting their short-term rental once the City has provided approval.

If you have issues updating your listing, please contact the short-term rental company that you are using (for example, Airbnb or Booking.com). The City does not have access to your listing and is not able to update and correct your listing on your behalf.

If you violate the bylaw, the City can revoke your short-term rental registration. You have 10 days to respond to the City’s notice of its intent to revoke your registration.

Once the 10-day period is up, the City will review your response (if received) and make their final decision, effective immediately.

You must inform the City within six days if any of the information that you provided during registration changes. This includes changes in phone number, email, and alternate (emergency) contact name or contact information and changes in your identification number or type (e.g. from Driver’s Licence to Photo Card). Please contact the Short-Term Rentals team at ShortTermRentals@toronto.ca or 416-395-6600, Monday to Friday. 8:30 a.m. to 4:30 p.m.

As a reminder, please do not send personal information, such as identification or credit card numbers via regular email.

If you are moving, then you must inform the City so that your short-term rental registration can be closed. If you want to short-term rent your new principal residence, then you will need to submit a new application to register your new address.

As of January 2025, all approved short-term rental registrations are subject to an annual compliance inspection. The operator is required to be present during the inspection of the short-term rental.

The City of Toronto is authorized to carry out inspections at any reasonable time to ensure that registered short-term rentals comply with Chapter 547 of the Toronto Municipal Code and all other applicable bylaws. Annual inspections help ensure that short-term rentals are operating legally, safely, and responsibly. They also support housing availability, public safety, and the fair use of the short-term rental program across the City of Toronto.

Short-term rental operators are required to submit supporting documents that demonstrate the registered property is their principal residence, with all non-essential information redacted before submission. Examples include:

All operators are required to provide evidence that is satisfactory to the Executive Director within 10 days of being requested to do so by the City of Toronto’s Municipal Licensing and Standards division. This includes scheduling an inspection of the property where the short-term rental is registered.

Failing to complete an inspection within a reasonable time may result in a revocation of the short-term rental registration.

Your registration is valid for one year from when your application is approved. Please renew every year on that same date or up to six days in advance. A notice of renewal along with instructions will be emailed to you before your registration renewal date.

Renew Your Short-Term Rental Registration

To continue short-term renting your home in Toronto, you must renew your registration online and pay a renewal fee using a credit card. The renewal fee for 2024 is $55.35, which is subject to an annual increase. The renewal fee is non-refundable. To complete the online renewal, you will need:

You can renew your short-term rental registration if:

If any of your information has changed, such as email address, phone number, alternate contact information or information on your Ontario Driver’s Licence or Ontario Photo Card, you will need to update it before renewal. Contact the Short-Term Rental Team at ShortTermRentals@toronto.ca or 416-395-6600, Monday to Friday. 8:30 a.m. to 4:30 p.m.

You can renew your registration up to six days in advance of your registration renewal date. For example, if your renewal date is November 2, you can renew from October 27 onwards. Renewing your registration in advance will not change your annual renewal date.

If you do not renew your registration and submit payment by 11:59 p.m. on your renewal date, you cannot short-term rent your home until you renew your registration and make a payment. If you continue to short-term rent without a valid short-term rental registration, you may be subject to enforcement action.

Please note that if payment is not received by your registration renewal date the non-refundable cumulative late fees below will apply:

After 90 days, your registration will be automatically cancelled and you will be required to apply for a new registration to continue to short-term rent. You will need to post this new registration number on all your listings.

If you would like to cancel your short-term rental registration, please email the Short-Term Rentals team at ShortTermRentals@toronto.ca. You will need to provide the following information:

You must request the cancellation of your own short-term rental registration. Another individual or organization cannot request to cancel the registration on your behalf.

You will still be responsible for remitting any Municipal Accommodation Tax (MAT) from your guest bookings until your registration is cancelled.

As a registered short-term rental operator, you are required to collect and remit an 8.5% Municipal Accommodation Tax (MAT) on rental revenues effective June 1, 2025 to July 31, 2026. The MAT payment is due on a quarterly basis, within 30 days of the end of the quarter. You are required to file a MAT report online for each reporting period, even if your short-term rental was not rented out.

Short-term rental companies can sign a Voluntary Collection Agreement with the City of Toronto to collect and remit the MAT on behalf of operators. If you are using these companies to advertise your short-term rental, you can allow the company to collect and remit the MAT on your behalf but will still need to file your MAT report online.

If your short-term rental company chooses not to sign a Voluntary Collection Agreement with the City, then you will need to file your MAT report online and collect and remit the MAT yourself.

It is your responsibility to ensure that the correct amount of MAT is collected and remitted to the City. The City may revoke your short-term rental registration or deny registration renewal if you fail to report and remit the MAT.

Learn more about filing the MAT report, making payments, HST, interest and due dates.

The City shall deny an application for, or a renewal of a short-term rental operator registration, where the applicant or registrant has:

Data related to the active status of short-term rental operator registrations are available at Open Data: Short-Term Rentals Registration. This dataset contains the registration numbers, full address (including street number, street name and unit, if applicable), property type (for example, condominium and single or semi-detached house), ward numbers, ward names and first three digits of the postal code for all active short-term rental registrations. Operator names and contact information are not included.

The information is used by short-term rental companies to enhance the operator verification process and ensure that all listings have valid registration numbers, as well as improve transparency in the program. This is also expected to reduce the number of unpermitted listings that may be found on short-term rental company websites and reduce the number of listings that may be removed due to the City’s compliance audits.

An operator’s name, e-mail address, contact telephone number, short-term rental address and details related to a property’s use as a short-term rental are considered business identity information and not personal information under sections 2(2.1) and (2.2) of the Municipal Freedom of Information and Protection of Privacy Act.

Key program data related to short-term rental operator registration, registration renewal and enforcement activities is available at Open Data: Short Term Rental Registration & Enforcement Overview. This data is updated monthly.

Residents can contact 311 to submit a complaint about a short-term rental operator. If there is a complaint or information about a possible violation, Bylaw Enforcement Officers investigate, educate and/or take enforcement actions.

The goal is to resolve issues and ensure that short-term rental operators are following the bylaw. Each issue is addressed on case-by-case basis to make sure reasonable, fair and appropriate actions are taken. For example, in some cases the issue may be resolved through education. In other cases, further enforcement action is required.

If short-term rental operators do not comply with the bylaw, they are guilty of an offence. If they are issued a ticket and convicted, they may have to pay a fine for the offence set out in the table below.

If operators are issued a summons to court and convicted, they may have to pay a fine up to $100,000 or a daily fine of up to $10,000 for each day the violation continues. In addition, they may have to pay a special fine for economic gains from the bylaw violation. If it is a corporation, every director or officer may have to pay a fine of no more than $100,000.

| Offence | Fine ($) |

|---|---|

| Failing to register a short-term rental | 1000 |

| Advertising, facilitating or brokering an unregistered short-term rental | 1000 |

| Failing to remove a listing for an unregistered short-term rental | 1000 |

| Renting or advertising property that is not a principal residence | 1000 |

| Advertising a short-term rental without a registration number | 1000 |

| Renting an entire unit for more than 180 days | 700 |

| Failing to provide evidence of a principal residence | 700 |

| Discriminating based on enumerated ground | 500 |

| Refusing to serve a person accompanied by a service animal | 500 |

| Failing to notify the City of a change in licensing or registration information | 400 |

| Failing to provide emergency contact information to a guest | 400 |

| Failing to provide information regarding 9-1-1 service to a guest | 400 |

| Failing to provide a diagram of exits from the building | 400 |

| Obstructing an authorized inspection | 400 |

| Making a threat or reprisal for participation in a public process | 300 |

| Making a threat or reprisal against an unlicensed business | 300 |

| Fail to keep complete transaction record for 3 years | 300 |

| Failing to provide transaction records within 30 days of a request from the City | 300 |

| Failing to report non-compliance with screening criteria | 300 |

If you require an accessibility-related accommodation to view notices and content related to Short-Term Rentals, please contact us at ShortTermRentals@toronto.ca or 416-395-6600, Monday to Friday, 8:30 a.m. to 4:30 p.m. The City will provide you with an alternate format, or provide assistance to support you with understanding the content.

Accessibility at the City outlines ways to access the City’s services and programs in a way that respects the dignity and independence of people with disabilities.