Moved Recently? Update your Payment Profile with your new property details.

Once you receive your first notice, sign in to your banking profile and make sure your account info matches your new bill.

We are currently receiving a high volume of inquiries related to property tax and utilities (water/sewer and solid waste billings). For your convenience, a list of the most frequently asked questions are below.

Property Tax Lookup

Access your account details, enrol in pre-authorized payments & eBilling or change your mailing address.

Access your utility account details and enrol in pre-authorized payments & Billing.

The deadline to declare your property’s 2024 occupancy status has passed. If you receive a Vacant Home Tax bill (Notice of Assessment) and wish to dispute it, you will be able to file a complaint. The online portal to file a complaint opens in early June.

2022-2023 Occupancy Status

To dispute a Notice of Assessment, please file a Notice of Complaint. Your phone number and email (optional) is requested. You may wish to keep a copy of your submitted complaint. Take a screenshot or print screen of your submission.

Mail: If mailing your complaint, property information such as roll number and address along with your signature is required. Also, please include the reason you are filing a complaint. Mail to: City of Toronto, Revenue Services

Vacant Home Tax Complaints/Appeals, 5100 Yonge St., Toronto, ON M2N 5V7.

You may file a Notice of Complaint for either the 2022 and 2023 taxation years by December 31, 2025.

Subscribe to e-updates and receive reminders and other information pertaining to the Vacant Home Tax.

It is the responsibility of the property owner to make payment on the tax account by the deadline. If a Notice of Complaint has been submitted and is pending review it is advised that payment and or a payment arrangement be made.

If your Notice of Complaint is successful and results in a credit balance, a refund will automatically be issued. If you would like to have the credit amount transferred to another receivable charged on your property tax account, call 311 – Tax and Utility Inquiry Line to request a credit balance transfer. Note: If a refund is already in process, a transfer of a credit request can not be accepted.

Note: The Property Tax Lookup is not updated in real time, which will result in a delay in viewing your information.

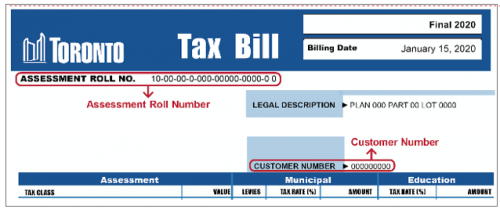

Your assessment roll number and customer number is required which can be found on a current property tax bill, statement or Vacant Home Tax Notice of Assessment.

There are many ways to make your property tax payments and utility bill payments including online banking and pre-authorized payments.

Online Banking

Note: Payment must reach our offices and the correct account to avoid loss of discount and penalty charges. A re-distribution fee will apply for payments made that must be redirected to the applicable account. Reminder to:

Pre-Authorized Payments

Eligible accounts may enrol online in the Pre-authorized Property Tax Payment Program (PTP) and the Pre-Authorized Utility Payment Program. (PUP).

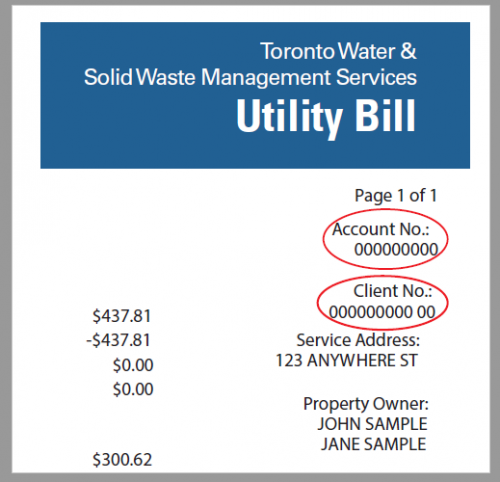

When making payments, locate on your most recently issued statement or bill:

| Property Tax |

Utility Bill |

| Use Assessment Roll Number (21 digits) | Use Account Number and Client Number (20 digits) |

|

For cheque payments, please remember to write your property tax roll number (21 digits) and/or your utility bill account number (20 digits) on the cheque.

Inquiry and Payment Counters and Drop Box Services

Property Tax, Utility and Parking Violation Inquiry & Payment Counters are open. Payment counters at Metro Hall remain closed.

To avoid late penalties and interest, please pay well before the due date, processing times for your payment can vary.

The Property Tax, Water & Solid Waste Relief Program is now accepting applications for 2025. You must reapply annually and submit supporting documentation.

Check on the status on your submitted application. Go to “Summary of Rebates

Once your application is approved, the water rebate will be posted as a lump sum credit on your first utility bill in the following year – check under “Account Adjustments” on the first utility bill issued in 2025. Solid waste rebates will be applied and prorated on each utility bill issued next year.

Industrial sector businesses negatively impacted by tariff-related issues may apply for the Industrial Property Tax Deferral Program. Rate payers in the industrial class have the opportunity to defer up to six months of tax payments and avoid any late fees, for the period of June 1, 2025, through November 30, 2025. Learn more.

If you require a current year tax receipt.

Alternatively, acquire account information through the Property Tax Lookup. Locate a previous bill and sign in to the lookup by entering information on the property tax bill.

The Vacant Home Tax has implications for property transactions, both for purchasers and vendors.

Learn more about the Vacant Home Tax.

Go paperless! Enrol in eBilling and receive notifications for your property tax and utility bills.

Property tax and utility for the current and previous year are available to view, save or download. Learn more on how to enrol in eBilling.

Your customer number is located on the upper portion of your property tax bill, directly below the legal description.

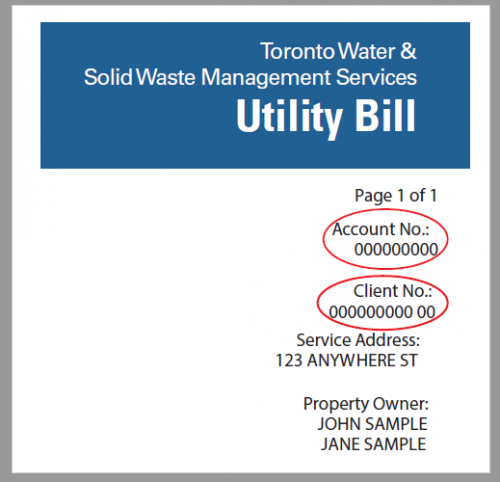

Your client number is located on the upper portion of your utility bill, directly below the account number.

Try these the following tips to help troubleshoot any difficulty you may have signing into the Property Tax and/or Utility Account Lookup:

Note: your Customer Number cannot be used to make payments – use your Assessment Roll Number and/or Utility Account Number for payment purposes

Contact a Customer Service Representative to help troubleshoot any problems you may be experiencing with the Property Tax and Utility Account Lookup tools.

If you would like to use the Property Tax and Utility Account Lookup tools your customer/client number is required.

Access your account details and change your mailing address. Requests are processed within approximately 48 hours.

Other ways to submit your request.

If you have recently sold a property or moved and require the City to close your utility bill account be sure to contact us to request a final meter read.

Learn more about Buying, Selling or Moving.

Log on to view your water use anytime, including total and average water use by day, week, month or year in an easy-to-read graph or chart format.

Toronto’s waste collection program is an all-or-nothing service. If your property opts out of City garbage collection, it will not be eligible for City collection of any other materials including Blue Bin recycling, Green Bin organics, Household Hazardous Waste, electronics and oversized items (e.g. appliances, furniture), all of which are collected for free from buildings receiving City collection. Learn more about opting in or out of City collection services.

If you have received estimated charges you may submit a meter read and billing discrepancies will be adjusted on future bills. Continue to make payment by the due date to avoid loss of discount and late payment fees. Learn more.

It is mandatory for all property owners to have a water meter installed on any pipe that delivers water into the building. Refer to Water Meters.

Refunds or transfers of a credit balance due to an overpayment requires proof of payment. Fees may apply.

Refer to Request a Refund or Transfer .