View your account details, enrol in pre-authorized payments and eBilling, & change your mailing address.

Get residential tax estimates instantly to help you plan and budget.

View your utility account details, enrol in pre-authorized payments and eBilling.

Moved Recently? Update your Payment Profile with your new property details.

Once you receive your first notice, sign in to your banking profile and make sure your account info matches your new bill.

Property tax and utility bills are mailed to the property owner or designate on file. Any payment received after the due date will result in late penalty and interest charges or loss of early payment discount with applicable fees.

Use the secure self-service Property Tax Lookup tool to update your mailing address to re-direct your property tax and utility bill. It’s quick, easy and convenient!

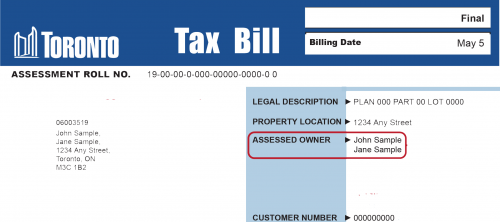

Login to the Property Tax Lookup by entering information located on your tax bill or property tax statement of account:

Enter your email address to place a request to change your mailing address.

Note: You cannot use this service to change the ownership of the property, or to notify the City of a change in ownership. To advise of a change in ownership, please follow the below ownership instructions.

Are you an owner of a newly constructed property and have received a Supplementary/Omitted tax bill? Submit your change of mailing address by mail, fax or in-person. Online mailing address changes cannot be processed for new properties at this time.

You may also update your mailing address by providing the following:

Submit your request by mail or fax:

City of Toronto

Revenue Services, Account Administration

PO Box 4300, STN A

Toronto, ON M5W 3B5

Fax: 416-696-3640 (refer to Tips on Faxing)

If you are a landlord/property owner you can add a tenant or agent to receive utility bills.

If you subscribe to eBilling, changes to your tax/utility account may affect how you receive your electronic bill.

Note: You cannot use the online service to change ownership on a property, go to Buying a Property – Update Tax & Utility Accounts for more information.

The Vacant Home Tax (VHT) is an annual tax levied on vacant Toronto residences.. The goal of the VHT is to increase the supply of housing by discouraging owners from leaving their residential properties unoccupied. Homeowners who choose to keep their properties vacant will be subject to this tax.

The Vacant Home Tax has implications for property transactions, both for purchasers and vendors.

Consult with your lawyer about obtaining a Tax and Utility Certificate; a certificate will provide:

If you are a new property owner and not aware of any upcoming tax instalments or utility bill due dates, penalty and interest is still applicable when payment is received late.

Update the ownership information for a property tax account by submitting a lawyer’s letter containing the following:

Once your ownership information has been updated, a Property Tax Account Statement will be mailed to you and will include an Ownership Change Fee.

Submit your request by fax or mail:

City of Toronto

Revenue Services, Account Administration

PO Box 4300, STN A

Toronto, ON M5W 3B5

Fax: 416-696-3640 (refer to Tips on Faxing)

There are many ways to make your property tax payments and utility bill payments. For the most convenient option, enrol in pre-authorized tax payments and pre-authorized utility payments.

When making payments, locate on your most recently issued statement or bill:

Property Tax |

Utility Bill |

|---|---|

| Use Assessment Roll Number (21 digits) | Use Account Number and Client Number (20 digits) |

If you have recently bought, sold or moved, be sure to update your new assessment roll number and utility account before making a payment. If you do not update this information:

What Should I Pay?

If you have recently purchased a property and are determining what is owed for the year in property taxes, refer to the Statement of Adjustments in the property purchase documents or consult with your lawyer.

Most homeowner’s utility bills will consist of water consumption/waste water and solid waste charges, billed in a four-month cycle – three times a year.

Meters are located inside the dwelling and track water coming into the home; most water meters have a transmitter, which sends water use information directly to a secure data collection unit for billing and administration.

Solid waste charges are added to utility bills whether you reside at the property or if the property is unoccupied. Charges are based on existing bin sizes at the property (small, medium, large, extra-large) at the time of sale and remain assigned to the property unless the new owner requests a change in bin size. If a request is made to change a bin size, applicable charges will be applied once your bins are delivered to the property.

When you receive your first bill, it is recommended you confirm the numbers located on the side of your existing bin(s) and compare that with the information found on your utility bill. If there are discrepancies, please contact 311.

If you have purchased a property and if it is to remain vacant, you may opt-out for garbage collection and request that the (green, blue, black) bins be removed from the property by making a service request.

Owners of newly built properties can only make payments to their tax account once a final tax bill is received. This occurs after the City receives property assessment information from the Municipal Property Assessment Corporation and occupancy has occurred.

If your name appears wrong (typo error) on your property tax or utility bill just contact our office to correct.

City of Toronto

Revenue Services, Account Administration

PO Box 4300, STN A

Toronto, ON M5W 3B5

If you will no longer own the property, you will need to finalize your utility account.

To request a final water meter read, contact a customer service representative and provide:

Your final utility bill will include a Special/Final Read Fee.

If you are enrolled in the PUP program, once your final meter read is processed, enrolment in the program is cancelled. You will receive a regular utility bill, and payment must be made by an alternative payment option by the utility bill due date.

Tenants enrolled in the designated mailing program (name is on the utility account, you are receiving and making payment on utility bills) may request a final meter read. You must provide your move out date, along with other information as shown above in request a final meter read.

If you no longer own the property but still receive the tax bill, please return the bill to the City with the required documents listed above in sending ownership information instructions. Should you have any questions, contact a Customer Service Representative.

If you have recently sold a property and are trying to determine what you owe in property taxes, refer to the Statement of Adjustments in the property purchase documents or consult with your lawyer.

Refer to Power of Attorney, Executor of Estate or Letter of Authorization if selling a home on behalf of someone else.

If you have recently sold a property and are trying to determine what you owe in property taxes, refer to the Statement of Adjustments in the property purchase documents or consult with your lawyer.

The assessment roll number and utility account number are assigned to the property, not the owner or resident. Use the assessment roll number and utility account with the client number from your most recent bill for bill payment.

You must notify the City in writing to cancel your enrolment in the Pre-Authorized Tax Payment Program or Pre-Authorized Utility Bill Payment Program when selling your property.

Refer to Power of Attorney, Executor of Estate or Letter of Authorization if selling a home on behalf of someone else.

The Vacant Home Tax has implications for property transactions, both for purchasers and vendors:

Learn more about the Vacant Home Tax.

The City of Toronto receives property assessment and information (return of the assessment roll) from the Municipal Property Assessment Corporation (MPAC) annually in mid to late November.

The City uses this property information from MPAC to generate the Interim and Final property tax bills. The name(s) and mailing address that appear on your tax bill are updated by the City; the name(s) that appear in the “Assessed Owner” field are based on the annual return of the assessment roll.

The City uses this property information from MPAC to generate the Interim and Final property tax bills. The name(s) and mailing address that appear on your tax bill are updated by the City; the name(s) that appear in the “Assessed Owner” field are based on the annual return of the assessment roll.

For example, if you purchased property after October 31, 2024, your 2025 Interim Tax Bill may still reflect the previous owner’s name in the “Assessed Owner” field. However, your name (the current owner) will automatically be updated to appear in the “Assessed Owner” field on your 2025 Final Tax bill and future bills. This update happens automatically and does not require any request from the new property owner.

Property owners can access information about their property by contacting MPAC at

1-866-296-6722 or by visiting the MPAC website to access the online tool AboutMyProperty

to review information on file for your property.

To change your name on your tax/utility account, submit your request along with a Name Change Certificate or Marriage Certificate.

Submit your request by fax or mail:

City of Toronto

Revenue Services, Account Administration

PO Box 4300, STN A

Toronto, ON M5W 3B5

Fax: 416-696-3640 (refer to Tips on Faxing)